Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Intel’s third-quarter earnings beat Wall Street expectations on Thursday, with the results showing a revenue bump combined with larger cuts and multiple, large investments over the past two months as CEO Lip-Boo Tan turned around the struggling semiconductor giant.

Intel’s revenue results and its $4.1 billion net income provide a much rosier view of its string of quarterly losses. But the company’s recovery story deserves several chapters devoted to cutting costs through layoffs and other cuts, as well as a series of high-profile investments from SoftBank, Nvidia and the US government.

Intel added $20 billion on its balance sheet During the third quarter, the company announced in its third quarter earnings presentation on Thursday, its stock increase. This increase is mainly due to three major investments in the company in the last three months.

In August, SoftBank invested $2 billion. A few days later, The US government took an unprecedented 10% equity stake at intel. The company has so far received $5.7 billion of a planned $8.9 billion from the US government. Nvidia also bought $5 billion worth of shares Intel in September as part of a broader agreement to develop the chips together over time.

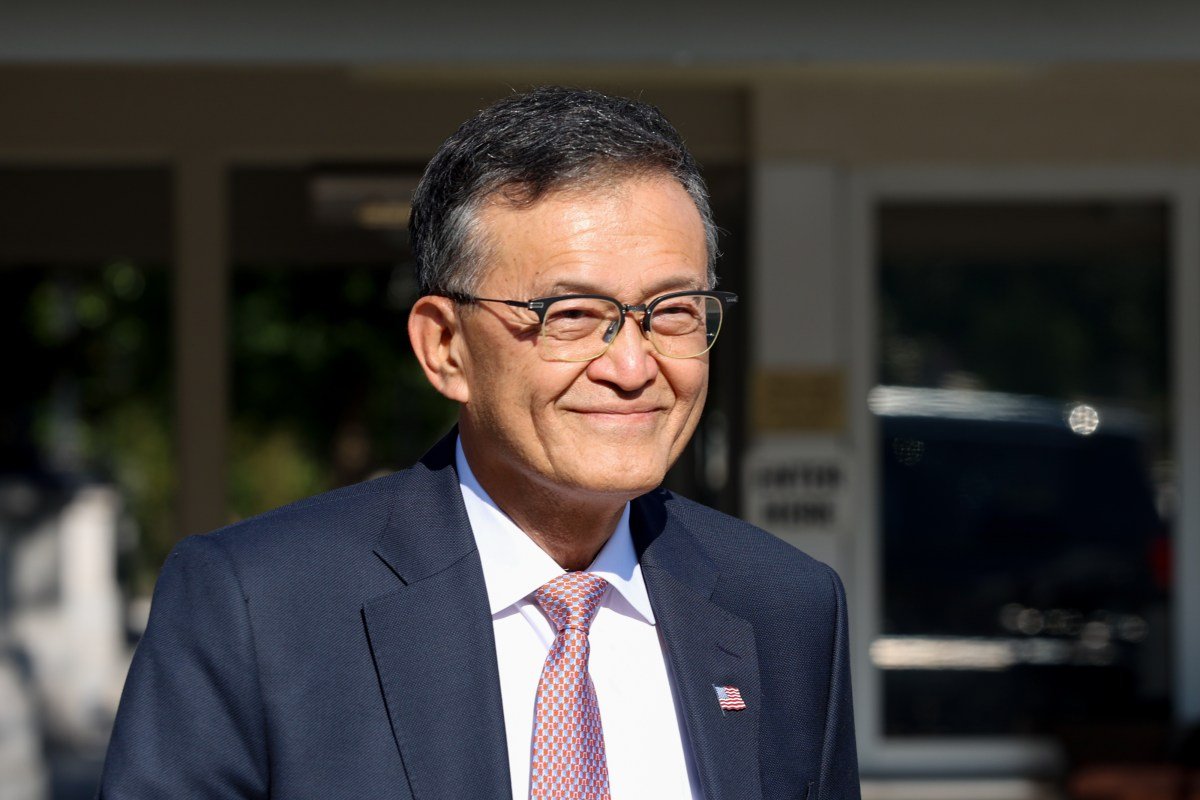

“The steps we have taken to strengthen the balance sheet give us greater operational flexibility and position us well to continue our strategy with confidence,” Tan said on the company’s earnings call. “In particular, I am honored by the trust and confidence of President Trump and the Secretary [Howard] Lutnik placed in me. Their support highlights Intel’s strategic role as the only US-based semiconductor company with leading edge logic, [research and development] and manufacturing.”

The company also received $5.2 billion from the closing Sale of Altera’s ownership stakeA hardware company owned by it since 2015, September 12. It is also sold Partnership with MobileyeAn autonomous driving technology company.

Intel said its quarterly revenue rose $800 million to $13.7 billion compared to $12.9 billion in the third quarter. Intel’s net income for the third quarter was $4.1 billion, a steep contrast from the $16.6 billion loss it reported in the same year-ago period.

TechCrunch event

San Francisco

|

October 27-29, 2025

Despite the strong quarter, there weren’t many details about what happens next with Intel’s foundry business, which makes custom chips for customers. The business has floundered from the start and Tan’s focus has been on those who started Significant layoffs in its foundry business this summer

Business appears to be a priority for the Trump administration; One of the main conditions of the government’s investment in Intel is that language will do this Intel will face fines if it is forced out of its foundry business In the next five years.

Wall Street is keeping a close eye on Foundry for signs of long-term growth for the company. Intel analysts told TechCrunch in August that the company Cash was not required A strategy to turn himself around but also to get his foundry business back on track.

Tan said Intel thinks its foundry business is “uniquely positioned” to capitalize on swelling demand for chips but was light on details — beyond saying the company is actively engaging with potential foundry customers — and added that growth in the foundry business will remain disciplined.

“Building a world-class foundry is a long-term endeavor founded on trust,” said Tan. “As a foundry, we must ensure that our process can be easily used by a variety of customers, each with their own unique way of making products. We must learn to please our customers as they rely on us to manufacture wafers, meeting all their needs for robust performance, yield, cost and schedule.”