Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

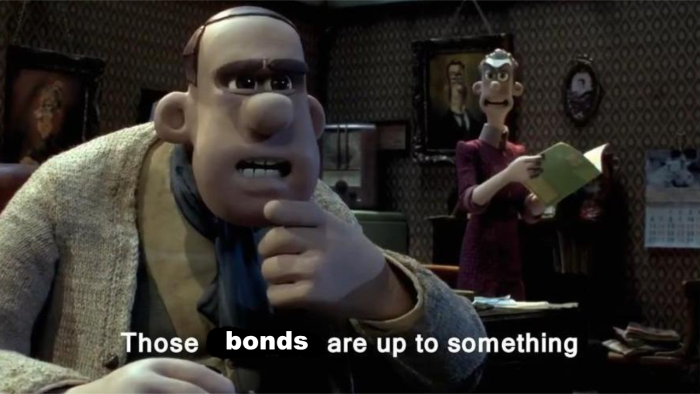

We love bonds, but we hate it when they make the front page. Let’s face it, there’s no good news about bond markets, even though they’re intellectually fascinating. It’s always “somebody’s to blame”, “someone’s screwing up the economy”, or some such awfulness.

Readers have been hard-pressed to miss the good coverage that bond yields have gained over the past few months. Or indeed front page The news They created gilts Above Last 24 hours.

There is a good example of what the current health crisis means for the government – and for the citizens of England in general -. In MainFT.

But we think it’s worth asking a slightly nerdier question: What has happened to bonds in the last few months?

step back most of the time The best answer to the question ‘Why are gilt stocks up/down?’ It is the ‘treasury market’.

While gilts haven’t moved on a basis-point-for-basis-point with Treasuries — and there’s always the possibility of a divergence — the 10-year gilt and 10-year Treasury have tended to drift together over the medium term. Bonds also tended to move closely to US government debt until the Eurozone crisis took a toll on European growth.

After the EU referendum, gilts have traded in limbo for a number of years, unable to join Bunds in an economic slowdown or Treasuries at a discount. In the year Following the shock of the Lease Trust mini-budget in autumn 2022, they have returned to business in line with the Treasuries.

The global production increase since mid-September may look surprising on this long-term chart. But sell-outs are both fun and useful. First, because of the nature of the sale. Secondly, because of the implications on other markets, as well as government finances.

‘The nature of the sale’? Is it getting FTAV?Comments‘? From “line up, Monkey sad?

Yes, actually.

The lowest point for gilts and US Treasury yields was on September 16, 2024 – two days before the Federal Reserve cut rates by 0.5 percentage point to 4.75-5.0% and three days before the Bank of England. Reserved rates fixed by 5 percent. Both E.F.D.R And The BOE They have since cut rates by 0.25 percentage points (on November 7).

With those yields lower, the ten-year Treasury yield rose 1.08 percent and the ten-year gilt yield rose 1.02 percent — to 4.7 percent and 4.8 percent, respectively, adding to the annual cost of any new debt. , and pushing down the value of existing bond holdings.

We know that nominal bond yields and changes in them can wax and wane over the long term between inflation (called the inflation rate) and real yield (the amount you’re promised after accounting for inflation). What is the expected increase in output due to inflation? some. But most of the increase in bond yields is due to the increase in real yields.

There’s no shortage of theories as to why inflation-linked bond yields trade where they do, though we’ve yet to find any false positives. You can Almost Think of it as a businessman R-star Financial Markets – The market’s best estimate of the medium-term equilibrium real rate for the economy as a whole. Although some people think R-Star is a load of baloney.

Gilt real yields have tended to be lower than U.S. Treasuries over the past decade. Based on the entire r-star theory, you could be forgiven for thinking that this gap reflects the market’s expectations for a downward trend in economic growth. And really, who knows? But a A common belief Inflation-linked gilt yields among UK investors are lower than you might expect because UK private-sector defined pension schemes have inflation-linked liabilities – and the large size of these buyers looking to hedge risk will drive yields down. Levels.

Here’s how real products have evolved over the past few years:

Nominal bond yields translate into expectations for average central bank policy rates over a period of time, while real yields, compressed by structural pension demand, tend to have higher inflation rates. And this is one explanation Forced-destruction The level of dismal inflation that has been typical of the UK market for most of the past fifteen years.

Today’s ten-year UK inflation-linked gilt gives a ten-year normalized (non-inflation-linked) total return of around 3.6% per annum. That’s a lot of inflation. But it’s no different from the 3.3 percent annual inflation that has averaged over the past decade.

Depreciated rates and real yields aren’t the only way we cut and dice bond yield changes. As we learned in Bond Boot CampIt also breaks down market expectations of overnight interest rate volatility (the market’s expected average policy rate) and asset volatility (the amount governments pay to rent private sector balance sheets, aka term premia).

Much of the rise in 10-year bond yields in recent months has been attributed to the market’s reiteration of central bank policy rates over the next decade. And this cool chart, courtesy of Christian Mueller-Glissmann of Goldman Sachs, shows how long-term bond yields are expected to respond to short-term Fed rate action. In September, options markets priced a sixty percent chance of eight or more declines in the next twelve months. Now the price is a 30 percent chance of one or more. Walks for the year.

But on this side of the pond, gilt yields rose slightly above expectations that the Bank of England would act alone. Lawrence Mutkin, head of EMEA rates strategy at BMO, said term premiums were becoming a bigger issue for bond markets around the world. According to him:

As Term Premia increases for Government, so does Term Premia for everyone else. This is what “cramming” looks like.

How might central banks respond to rising prepayments? Maybe by cutting rates? If so, this – argues Mutkin – is the dominance of the budget in action. 😬

How is this word premia growing? not good. While gilts have been very cheap relative to swaps in recent months, this only takes them to levels reached by US Treasuries along their yield curves. Is this the result of QT / excessive government supply? Please answer in the comments.

We just realized we threw a lot of charts at you. And while it’s not the usual thing to do, we really don’t see why we shouldn’t combine these disparate bits and pieces into one overall graphic to show not only what happened to the ten years of Bond production, but also others. Tenants too.

So, “How much have bond yields risen since mid-September?” The answer to the question “Treasury and Treasuries are close to one percentage point to maturity for bonds between five years and thirty years,” the reasons for these movements vary:

The simple reason bond yields are higher in both markets is that markets expect the Federal Reserve and the Bank of England to keep interest rates high not just next year, but for the next five, ten, even thirty years. In the middle of September.

At the same time, bond market gauges of inflation expectations did not jump, but this is likely because markets expect the Federal Reserve and the Bank of England to hold interest rates higher than they did in mid-September.

In the UK, there was some discounting of gilts as the ten-year gilt term premium rose rapidly to levels seen in the UK Treasury market.

None of this helps you understand the day-to-day movements in bond markets that happened yesterday – unlike some weakness in managing rate locks from investment banks, the results of Mehr’s five-year gilt auction, to bond vigilantes testing the Chancellor’s mettle. But hopefully it provides some useful context.

Further reading:

– Price sales will continue until morale improves

– Everything You Always Wanted to Know About Bonds (But Were Afraid to Ask)