Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Get free updates

Register easily Financial management myFT Digest — delivered straight to your inbox.

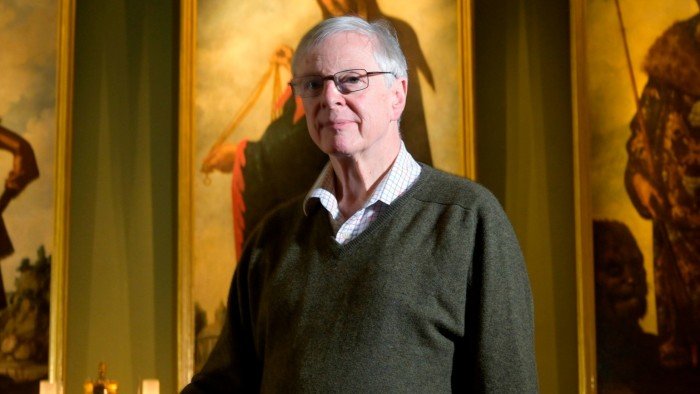

UK multi-millionaire Jonathan Rafer has admitted the popular investment boutique “failed to meet its targets” for clients for the second year in a row by offering less than its cash return.

Ruffer, who co-founded Ruffer Investment Management three decades ago, said in his annual review that the £20bn firm’s strategy for 2024 and 2023 had lagged behind its financial benchmarks.

The firm is chaired by the philanthropist whose investment approach has been hurt by the belief that the U.S. stock market will fall and that the Japanese yen will strengthen against the dollar as it wrong-foots the ruffian’s currency.

The S&P 500 was Rising by more than a fifth by 2024, Rufer’s core cash-back fund yielded 4.4 per cent in the year to the end of September last year, compared with the UK bank rate of 5.25 per cent, according to the firm.

“We set out to explode when the S&P was so low. That was wrong, but not wrong — the characteristic of a bubble valuation is that it somehow over-assumes a trip to the moon,” Rufer said in his annual update.

“The yen kept going down and the exporters went up. If we had kept 4 percent of the portfolio in these equity offsets, we would have typically made solid returns. . . We didn’t do it. Because we were particularly concerned about equity risk as an asset class.

“Abandoning that single error, single-handedly, would not have saved our performance in terms of cash and cash returns, but it would have helped tremendously.”

His comments came after the firm paid out £89.8mn in shares until the end of March 2024 – nearly £2mn for each of its 44 partners – down from £95mn last year. Operating profit fell 14% year-on-year to £119mn.

Rufer Flag Total Return Fund aims to deliver consistent positive returns “regardless of the financial market.” But the strategy returned a negative 3.8 percent in 2023.

The fund’s boutique has been focused on equity markets, holding defensive positions in long-term, inflation-linked bonds and short positions in growth stocks.

But Raffer said that the company will continue its investment position. “We’re going to continue the bull run; the assets we’re picking feel like they’ve had good days with bad weeks.

“It’s no accident that we still have a portfolio that can take full advantage of a certain amount of systemic shock. Why would someone say that without arrogance? It corresponds to the price level of the main US equity market in three words: the S&P at 6,000.”

The investment company last year Cut about 20 roles From its then 330-strong headcount, including positions in the private client and risk groups.