Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Get free updates

Register easily UK inflation myFT Digest — delivered straight to your inbox.

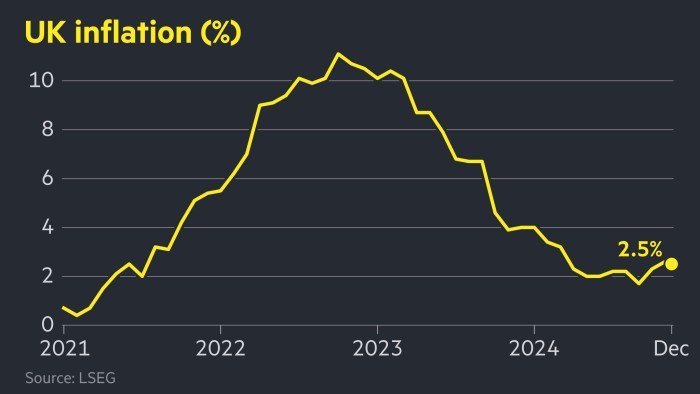

UK inflation unexpectedly fell to 2.5% in December as the economy weakened, easing pressure on Chancellor Rachel Reeves and paving the way for the Bank of England to cut interest rates further.

The consumer price index was 2.6 percent lower than in November. Analysts had expected inflation to continue last month.

The data will provide some relief to Reeves, who is struggling with high borrowing costs fueled by fears the UK economy could be heading into recession.

The report, from Office of National StatisticsIt comes as the BOE’s Monetary Policy Committee prepares to hold its first meeting of 2025 next month. Investors are betting the central bank will cut by a quarter-point to 4.5 percent.

Thomas Willadek, chief European economist at T Rowe Price, said the data was “a clear green light for another series of cuts”.

of Boe In the year He predicted that the economy would slow down in the last quarter of 2024. Business surveys suggest weak confidence and employment may hold back inflation.

“There is still work to be done to help families across the country with the cost of living,” Reaves said Wednesday. “This is why the government has taken steps to protect workers’ wages from higher taxes, suspended fuel taxes and raised the country’s minimum wage.”

Wednesday’s data showed the services. InflationA measure of core inflation, closely watched by the BoE, fell to 4.4 percent from 5 percent previously. The services inflation reading was below economists’ expectations of 4.9 percent.

Core inflation, which excludes food and energy, fell to 3.2 percent from 3.5 percent.

The pound weakened slightly after the data was released, down 0.3 percent on the day at $1.218. Traders in volatile markets had factored in a quarter-point cut to a 60 percent chance next month, based on levels before the data was released.

Zara Knox, asset management analyst at JPMorgan Asset Management, said: “After a difficult start to the year, this morning’s rise in prices is a relief for Chancellor Reeves. Adhesive printing may account for more volatility in the gilt market.

The central bank cut the key rate to 4.75 percent in two quarter-point moves last year.

Additional reporting by Ian Smith