Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

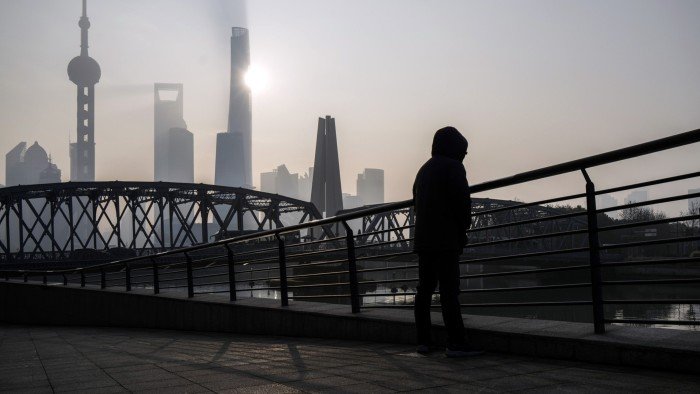

China’s central government is trying to crack down on arrests of business executives by local authorities, which has increased anxiety among entrepreneurs and risks undermining efforts to boost economic growth.

A Financial Times document review found high figures in more than 80 companies listed on the Shanghai and Shenzhen stock exchanges in 2024.

ChinaThe securities regulator has listed and forced companies to disclose arrests of shareholders, chairs, CEOs and other senior managers, and the numbers suggest a wider crackdown on executives across the country.

Some of the arrests appear to have little or no legal basis, and in most cases were carried out by officials far removed from the target’s business operations, which Chinese media have called “long-distance fishing.” An official document from the southern province of Guangdong says thousands of companies in one city have been targeted by authorities in other areas since 2023.

Premier Li Qiang this month called for stricter control of company-related law enforcement agencies, saying the government would review those with abnormal revenue growth with fines and raids or high-level performance outside their jurisdiction.

“The situation of abuse of administrative discretion and unfair enforcement continues in certain areas and sectors,” Li said, according to the official news agency Xinhua. The prime minister added that it was important to address “pressing issues raised by citizens and businesses”.

Analysts say the high number of prisons may be due to declining revenues from land sales due to the deteriorating financial situation of local governments. National property crisis This has slowed China’s economic growth.

“My friends are being oppressed from all sides,” said a senior Chinese investor, adding that some local governments are assessing residents’ property and fining the super-rich.

The investor, who did not want to be named, said some areas had been turned into “long-distance fishing” after he was forced to pay off local authorities to be released from detention a decade ago.

“I will sue you for the violations you have committed in my region and I will make you pay for it,” he said, showing the position of the local authorities. “It’s like a nationwide tremor.

In the year Of the 82 company-related arrests reviewed by the FT in 2024, nearly half were officials from other states or an undisclosed location.

Eugene Weng, a lawyer at Shanghai-based Wintel & Co., said some of his clients have experienced abusive law enforcement practices by officials from other areas. Erosion of self-confidence In a business environment.

“The feeling of anxiety went beyond thinking,” Weng said. “Entrepreneurs are only thinking about the short term, taking profits as soon as possible instead of investing in their businesses and transferring money abroad as soon as possible.

He added: “This will actually worsen tax revenue and employment, which will send domestic finances into a vicious circle.”

An internal report prepared for Guangdong’s provincial leaders in April, which was later released online, said cross-compliance was ensnaring a growing number of local companies.

As of 2023, “about 10,000 enterprises in Guangzhou city have encountered law enforcement agencies from other areas, most of the cases are related to private enterprises and there was a clear profit-seeking motive,” he says.

According to one Beijing-based entrepreneur, the arrest has created an atmosphere of fear among founders. “It’s scary when you start getting to know people who are incarcerated,” he said. “The government must do something.”

China’s opaque enforcement system compounds these concerns. Companies say they and the families of arrested executives have received little information about their cases.

Smart city solutions provider Zhejiang Weis Technology CEO Ye Jianbiao struggled to respond to requests from security regulators in March for more information about the arrest.

The board, on the other hand, stated that apart from a notice from another city’s anti-corruption office that he was “being investigated for work-related crimes”, neither he nor his family had “received any other formal notification or document”. “Knowing the process or conclusion of the investigation.”

Nine months later, the 51-year-old executive remains in prison. We could not be reached for comment. The representative of the company stated that they do not have any further information on Ye’s case and said that they will announce that he has been released from prison.

Some states have begun publicizing efforts to protect private companies. Last month, prosecutors in eastern Zhejiang reported that local police had helped foil the kidnapping of an entrepreneur named Shen by officers from another area.

After being kidnapped from his home, Shane flees from the police as he is taken from the state. Zhejiang police arrested the two officers outside the city, initially claiming they were acting on orders from their superiors, and eventually arrested them.

In some cases, the arrested executives end up in the hands of the authorities in areas where they seem to have no business.

Zhang Jian, 55, has spent more than two decades building Aima Technology Group, one of China’s largest electric scooter makers. The family’s 73 percent stake in the group is worth Rmb19.5bn ($2.67bn), placing it at No. 247. China’s “Rich List” Compiled by Hurun Research Group.

But in October, Aima Zhang announced that he had been arrested by anti-corruption squads from the city of Chengdu, hundreds of kilometers from his home, and from the company’s headquarters in Tianjin. According to public documents, Aima does not own any property in Chengdu.

“They say they are personal matters, but they won’t tell us more,” said an Aima manager on condition of anonymity.

The manager said that Zhang was able to send important company documents to sign since Aima was arrested, and they hope that he will be released soon.

“Most of the arrested chairmen will be out in two or three months,” said the manager. “I can’t say how long ours will last, but this is the situation in the market.”

Data visualization by Haohsiang Ko