Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Jessica Murphy,Ottawa and

Nadine Yusif,Ottawa

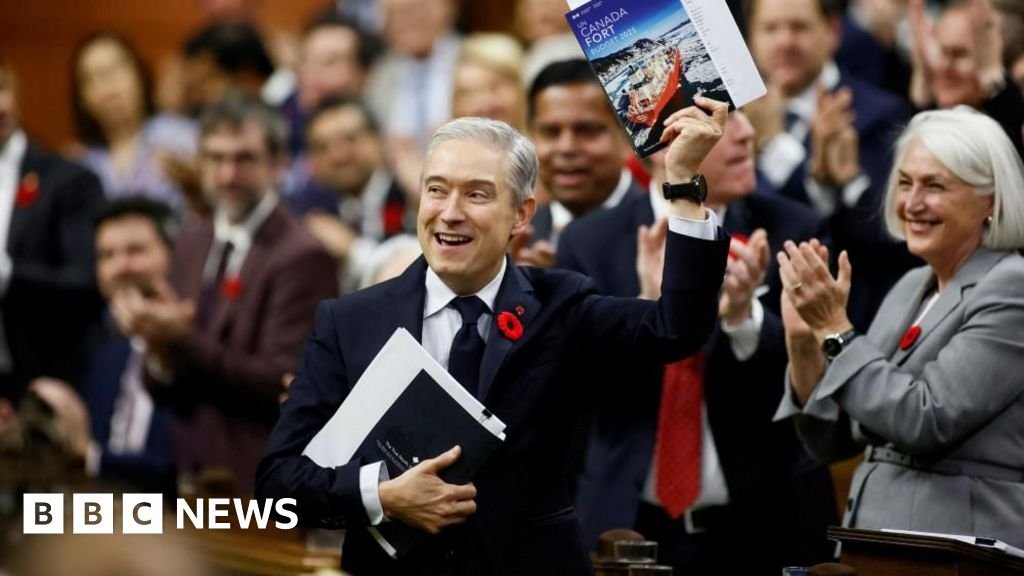

Reuters

ReutersCanadian Prime Minister Mark Carney has unveiled his first federal budget, a blueprint for how he plans to deliver on his promise to make Canada’s economy the strongest in the G7.

The ambitious plan, seen as a key test for the new leader and former central banker, is as much a policy document as a spending plan.

He warns that Canada is in an era of “significant change” not seen since the fall of the Berlin Wall, highlighted by a rapidly changing relationship with the United States, once the country’s closest ally.

“There are headwinds on the horizon,” Finance Minister Francois-Philippe Champagne told reporters in Ottawa on Tuesday. “That’s why we need a strong response.

Here are six takeaways from the spending plan.

The budget includes billions of dollars in spending that could push Canada’s deficit to C$78.3 billion (£42.6 billion) – the second largest in history.

Carney and Finance Minister Champagne defended the massive spending plan, which will total C$280 billion, as an investment to boost Canada’s global competitiveness and claimed the strategic injection of funds would attract C$1 trillion in investment back to Canada over the next five years.

It will fund a wide range of areas: highways, ports, power grids, digital corridors, defence, housing and initiatives that promise to boost Canada’s productivity.

But Carney also warned Canadians of the “sacrifices” needed in his plan to transform the economy, with the budget calling for total spending cuts of C$60 billion over the next five years.

These come in part from the reduction of 40,000 public sector jobs by the end of 2029 – around 10% of the workforce will be cut through attrition, job cuts and the widespread adoption of AI.

Federal departments could see up to 15 percent in cuts in coming years, which is expected to result in more than C$44 billion in savings, according to the budget.

For the first time in Canada, the fiscal plan made a distinction between government spending on operating expenses — day-to-day government spending — and capital investment, defined as financing that should help grow the economy.

Because of its proximity and close cultural ties, the US has long been Canada’s largest trading partner, with about 70% of trade moving south.

In the wake of Trump’s tariffs and the uncertainty that has come with them, Canada is looking to Europe and Asia to double exports outside the US over the next decade.

Carney’s budget offers millions in support for companies working to develop new export markets, includes help with legal costs and market research.

There is also a nod to growing cultural ties to Europe, such as an exploration of Canada’s participation in the Eurovision Song Contest.

With some firms hoping to save trade costs by moving facilities south to the US, Carney is also proposing a range of initiatives to make Canada more attractive. This includes a set of measures that would reduce Canada’s marginal effective tax rate to 13.2% from 15.6%.

“It’s a great message for investors,” Champagne said, noting that the rate will be lower than the U.S. rate.

And with many American universities facing uncertain funding under the Trump administration, the spending plan includes C$1.3 billion to attract international researchers to Canadian universities and money to support their research.

Like other resource-based economies, Canada is struggling with balancing its need to increase production of commodities like oil and gas while maintaining its climate commitments. Oil-rich provinces like Alberta have lobbied hard for the federal government to scrap some environmental initiatives, arguing they harm development in the region.

Carney’s fiscal plan proposes making Canada a “clean energy superpower” by supporting the development of low-emission energy projects such as nuclear reactors and low-carbon liquefied natural gas.

At the same time, the government is pushing for the development of carbon capture and storage technologies as well as stronger methane regulations.

He also reaffirmed his commitment to the industrial carbon tax, calling it a policy “that delivers more emissions reductions than any other.”

To encourage investment, the Carney government says it will work with the provinces on what carbon pricing will look like in the long term to provide more stability for companies.

These initiatives would replace the cap on oil and gas emissions put in place by Carney’s predecessor, former prime minister Justin Trudeau.

It’s all billed as part of a climate competitiveness strategy that the Carney government says is “a central pillar of Canada’s plan to become the strongest economy in the G7.”

Carney has promised Canada will significantly increase defense spending to meet NATO’s goal of 2 percent of GDP this year and 5 percent by 2035 as the country grapples with an aggressive Russia and a more powerful China, as well as security threats in the Arctic.

The budget outlines C$81.8 billion in defense spending over the next five years, the largest sum in decades for a country that has long lagged behind in military funding and struggled with procurement.

The spending includes pay increases for the armed forces, funding for digital infrastructure and plans to develop Canadian supply chains.

There is also C$182.6 million over three years for the Ministry of Defense to establish a space launch capability.

Another focus is the Arctic. The Carney government says it is looking at developing dual-use, all-weather infrastructure projects in Canada’s north that can be used for both economic and security reasons, committing C$1 billion over four years to the effort.

Carney’s first act as prime minister was to get rid of one of his predecessor’s signature climate policies, the consumer carbon tax, which had become politically unpopular.

He continued to break with Trudeau, who has been in power for almost a decade, by rejecting the mandate to sell electric vehicles and reversing a proposed increase in Canada’s capital gains tax.

The budget marks another major breakthrough, on immigration.

Trudeau dramatically increased the number of immigrants allowed into Canada before announcing sharp cuts last year amid concerns about the growing numbers and possible stress on housing and social services.

Carney’s budget significantly reduces targets for new temporary residents from 673,650 to 385,000 next year and 370,000 in 2027 and 2028. There is also a one-time measure to speed up the transition of up to 33,000 work permit holders to permanent residents.

Other Trudeau-era policies that have now been rolled back include the “2 billion trees” program announced in 2019, which saw only about 160 million trees planted by the end of 2024, and the end of the luxury tax in 2022 on vehicles and planes priced over C$100,000 and boats over C$250,000.

The latter “cost more to administer” than it collected in tax revenue, Champagne said.

The Trump administration’s trade war affects a wide range of Canadian businesses as it imposes a blanket tariff of 35% on Canadian goods not covered by a free trade agreement, along with sector-specific levies on steel, aluminum, lumber and autos.

The Carney government wants to spend C$5 billion over the next five years to help these sectors, including C$1 billion to fund the steel industry’s transition to new business lines.

It also launched a loan, valued at C$10 billion, designed to support “otherwise successful Canadian businesses” as they weather tariff-related storms. The first recipient of the loan is Algoma Steel Inc, an Ontario-based producer that has faced layoffs since the U.S. imposed tariffs.

The proposed Buy Canadian policy would also prioritize the sourcing of Canadian goods and suppliers for government-funded projects.

Part of Canada’s response to the tariffs will be funded by revenue it has collected from its own countermeasures to the U.S. tariffs. As of October 2025, Canada has made $6.5 billion in gross revenue from these measures, according to the budget.